COP 28 – The Bridge Tank’s takeaways from Dubai

Since 2015 and COP21 in Paris, The Bridge Tank’s presence at the Conference of Parties has become an annual opportunity for our think tank to contribute to public debate on climate action and sustainable development. This year’s COP28 in Dubai, UAE, was no exception, as Joel Ruet, Chairman of The Bridge Tank took part in the conference from November 30 to December 4, in coordination with the French Water Partnership and the International Network of Basin Organisations (INBO).

Beyond the official negociations, marked by tensions and frustrations but which resulted in a landmark agreement nonetheless, COPs are an opportunity to regularly engage with change makers from around the world, discover success stories and projects developed by creative practitioners and learn more about the latest innovation milestones on those topics that have been at the heart of The Bridge Tank’s actions over the years, i.e. energy transitions, economic growth models and the role of the industry, agriculture and land adaptation. These themes all witnessed progress at COP28, as fossil fuels were mentioned in the final agreement, as commitments by industrial actors multiplied and as the loss & damages fund was enacted.

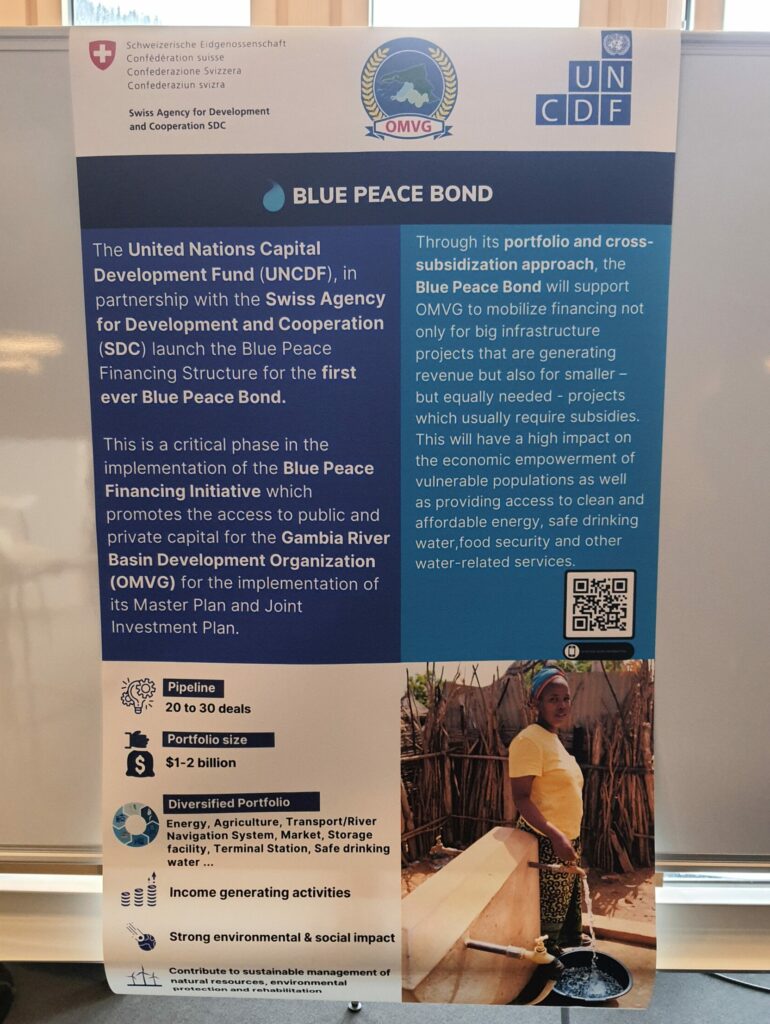

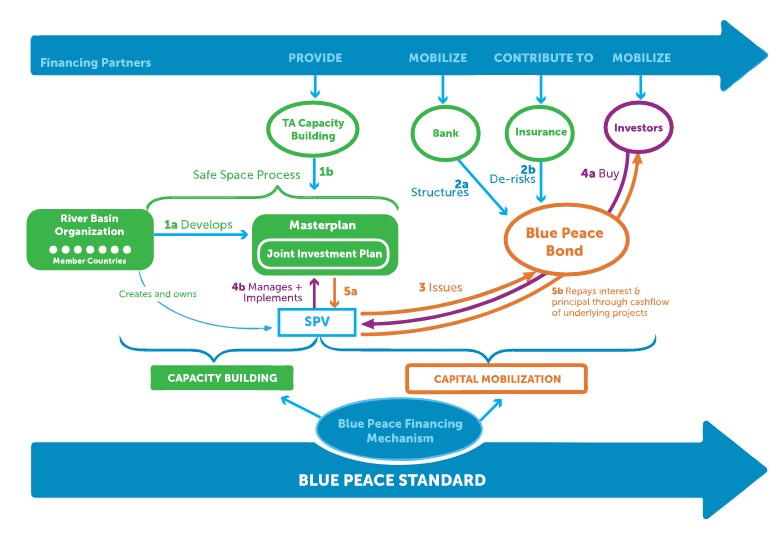

Besides, The Bridge Tank had the privilege of being directly involved in the presentation of two of those success stories originating from West Africa, which assessed the contribution to the development of the region:

– provided by the hydroelectric infrastructure and associated programs carried out by the Organisation for the Development of the Senegal River (OMVS). The side event was convened by the OMVS and SOGEM, with the official support of CILSS, which welcomed the event on its pavilion, and The Bridge Tank.

– offered by innovative finance for climate projects, with the official launch of the Climate Study Fund of the West African Development Bank.

For more on our board members’ participation in the COP in Dubai:

Food security : governance, security and climate resilience

Illustrating the growing awareness taking hold on the intersection between issues of governance, security, and climate change, the Munich Security Conference (MSC) was an important contributor of this year’s COP28 in Dubai. One issue particularly stands at the crossroads of these diverse challenges : food security.

On December 2, the MSC therefore organised a closed door side event titled “Dried Up: Strengthening Resilience of Food Systems in Light of Climate Change.” The event explored how climate change contributes to current food insecurity, a crisis already aggravated by Russia’s war in Ukraine, various regional conflicts, the aftermath of the COVID-19 pandemic, economic shocks, and supply chain challenges across the globe.

How can efforts to fight climate change and hunger best be aligned? How can COP28 serve as a platform to bring the two policy communities together to address the ripple-effects of climate change on global food security? These were some of the questions driving the discussion between:

- Cindy Hensley McCain, Executive Director, United Nations World Food Programme

- Vera Songwe, Chairwoman of the Board, The Liquidity and Sustainability Facility

- Ricarda Lang, Co-Chairwoman, Alliance 90/The Greens Parliamentary Group

- Nisreen Elsaim, Chair, Sudan Youth Organization on Climate Change, Khartoum

- Michael Werz, Senior Advisor, Munich Security Conference (Moderator)

One issue of particular interest to The Bridge Tank is how to finance land restoration along with sustainable and job-creating agriculture, notably in Africa. Our engagement with African Leaders has led us to the idea that a transitory use of natural gas earnings is the way to finance these required investments, in a dual context where sub-saharan Africa has not been a contributor to climate change and needs to fund its sustainable transition on the one hand, while on the other hand, the Global North sees natural gas as a stage of the energy transition.

After these intial investments that would include funding the dissemination of renewable energies in the field, this financing transition could come to an end ; the main message from COP participants from the South being that they increasingly want to rely on sovereign funding for their transformations and not depend on the North when they can. Joël Ruet was able to share these views with the panelists. It is in this very spirit The Bridge Tank is ready to contribute to the task force the Munich Security Council endeavours to launch.

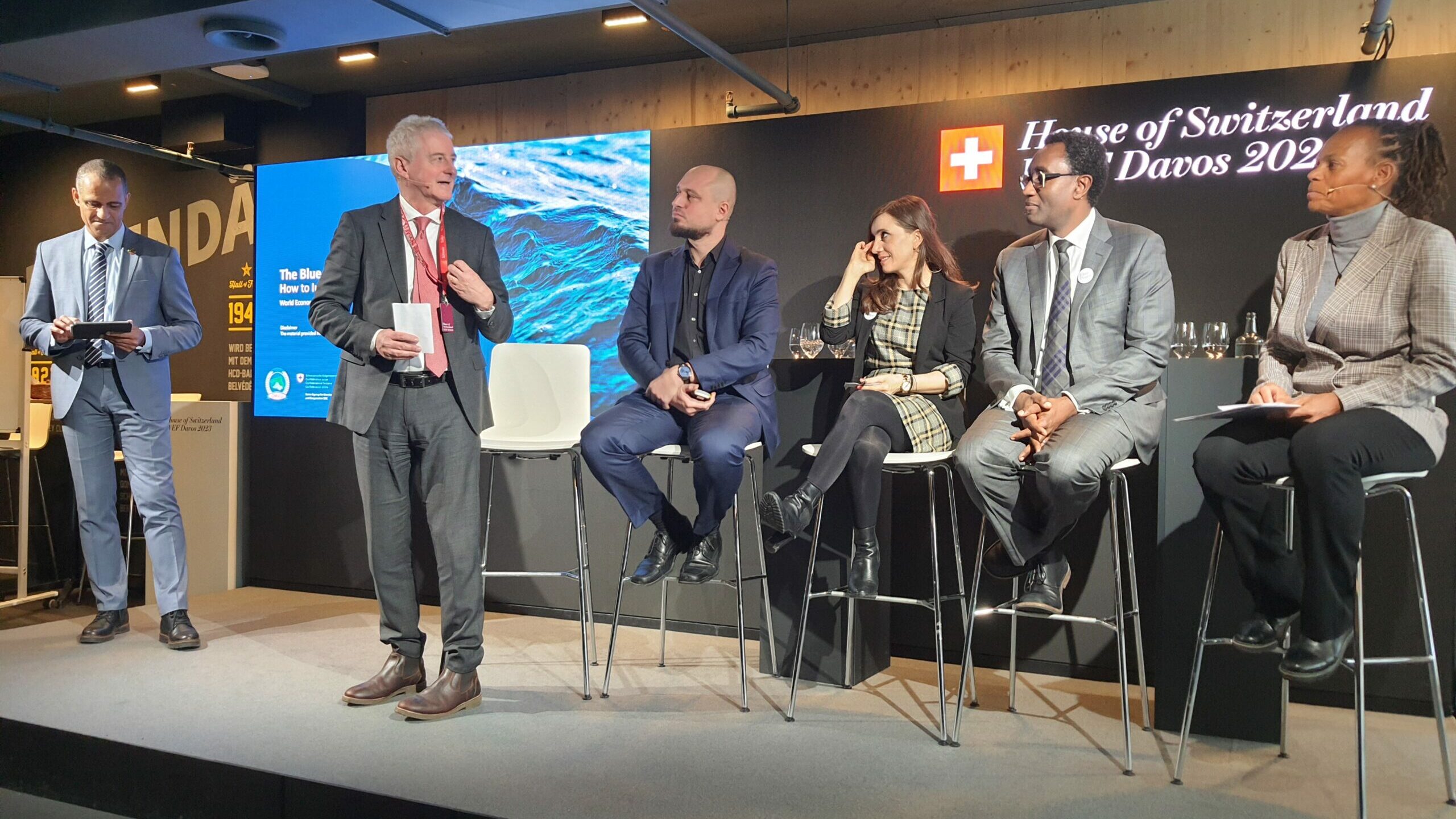

Sustainable trade and free trade as enablers to fight climate change

The previous day, on December 5, Joel Ruet had already been convened to a high level reception on “Sustainable and Inclusive Trade as an Engine of Economic Growth & Prosperity.”

The reception notably brought together:

- Hillary Clinton, former Secretary of State of the United States,

- Dr Ngozi Okonjo-Iweala, Director general of the World Trade Organization,

- Maha AlQattan, Group Chief Sustainability Officer, DP World.

Hillary Clinton quoted late Madeleine Albright, saying “I’m an optimist who worries a lot,” thereby finely translating the spirit of COP28 participants at this time of the negotiations. She recalled the efforts of the Global Clinton Initiative towards environmental sustainability and celebrated the fact that an agreement could be reached on loss & damages.

Nonetheless, the fight against climate change also requires a deep long-term agenda, with free trade as part of it, albeit in a rethought manner, Dr Okonjo-Iweala recalled. Indeed, as further mentionned by Dr Okonjo-Iweala, free trade so far has had pros and cons: the pros definitely being on its capacity to provide widespread distribution of green technologies that have been scaled up at rapidly decreasing cost ; the connectivity and the development of the logistics chain have also ensured their reach inland, way beyond capitals or main harbours, a point DP World’s guest was also keen to emphasize. On the needed improvements of the imprint of free trade, Dr Okonjo-Iweala recalled several positive trends or turnaround points on introducing ESG best standards into the global chain, notably insisting on the leveraging effect of the shipping industry.

Dr Okonjo-Iweala more generally recalled the role of coordination betwen industrial actors, governments and finance, a line of analysis which runs through the history of The Bridge Tank since our inception, based on which we notably contributed to the Energy and Climate task force under the 2023 G20 presidency.

Last but not least, she introduced a welcome progressive outlook at free trade not beeing sought per se, but being accompanied with transparency, equitable norms and social progess in countries and economic systems that want to participate in the WTO system. The attendance, gathering select people from industries and geographies across all continents, could really nod on the fact that a silent revolution is under way.

Accelerating the energy transition : Economic tools and Actors

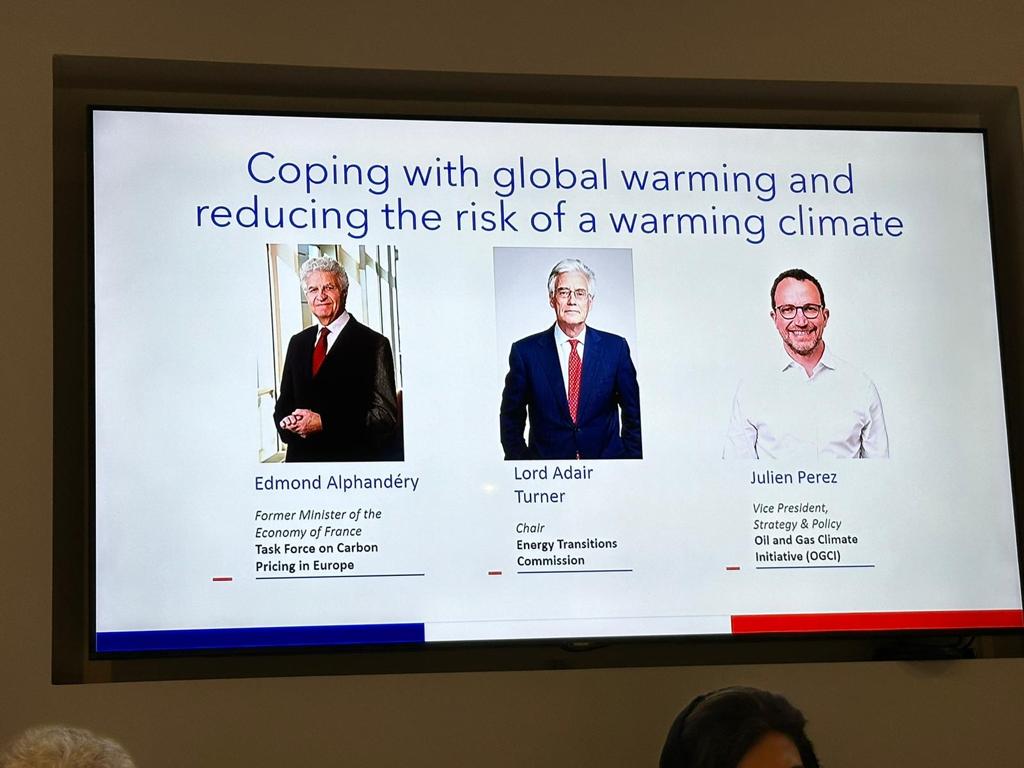

A key side-event co-organised by the Task Force on Carbon Pricing in Europe chaired by Edmond Alphandéry, former Minister of the Economy of France, and the think tank The Climate Overshoot Commission chaired by Pascal Lamy former DG World Trade Organization, provided a detailed account of state-of-the art thinking in terms of economic tools, technology prospects, and environmental and moral priorities on curbing GHG emissions.

While the IMF representative notably presented results of a landmark study describing the distribution of subsidies to fossil fuels according to production capacities, and Lord Turner presented the updated version of the Energy Transiton Commission approach on the respective role of various technologies, Joel Ruet suggested to work at a connection between the two, not only linking the two parameters but also anchoring them into geographies, in order to set the ground for optionable scenarios and policies.

The Bridge Tank having been a regular participant of the Task Force, we were happy to see the continuous progress over time of its results and achievements.

The side event “Coping with global warming and reducing the risk of a warming climate” gave the floor to :

- Edmond Alphandéry, President of the Task Force on Carbon Pricing in Europe, former Minister of the Economy of France;

- Dora Benedek, Division Chief, Climate Policy Division, Fiscal Affairs Department, International Monetary Fund;

- Lord Adair Turner, Chair of the Energy Transitions Commission;

- Julien Perez, Vice President, Strategy & Policy, Oil and Gas Climate Initiative (OGCI);

- Pascal Lamy, Chair of the Climate Overshoot Commission, former Director-General of the World Trade Organization;

- Hina Rabbani Khar, former Minister of Foreign Affairs of Pakistan, member of the Climate Overshoot Commission.

In GHG mitigation, actors matter. On December 5, Joel Ruet was invited to join a dinner on “Accelerating the Energy Transition: The Need for Collective Action,” organised by the Emirati logistics company DP World and gathering a blend of economic actors in the harbour and shipping industry, NGOs engaged into adaptation, and industrial apex bodies. This was in line with The Bridge Tank’s participation into the working groups of the Business20 of the G20.

The event discussed possible avenues of action to facilitate and accelerate the transition to low-carbon energy sources, a longtime subject of interest for The Bridge Tank.

The “fireside chat” format of the discussions welcomed contributions from Jesper Kristensen, Group Chief Operating Officer, Marine Services DP World, Tiemen Meester, Group COO, Ports & Terminals, DP World, Sue Stevenson, Director of Strategic Partnerships and International Development, Barefoot College International, & Federico Banos-Lindner, Group SVP, Government Relations & Public Affairs, DP World. The chats were facilitated by Lynn Davidson, former Advisor to COP26 President Alok Sharma and included remarks by Rajiv Ranjan Mishra, COP28 Delegation Leader, Confederation of Indian Industry (CII).

Climate change adaptation and resilience

Having recently worked with Haiti’s UNDP country office on Haiti’s National Adaptation Plan, The Bridge Tank took a special interest in a session on “Climate change, insecurity and mobility in fragile states: A new approach to climate adaptation and peacebuilding” held at the Somalia pavilion and hosted by the UN Environment Programme, the Ministry of Environment of Haiti, the Somali Greenpeace Association, and the UN Climate Security Mechanism.

Building on this theme of adaptation, The Bridge Tank also attended a side event on “Locally led iterative learning and transformative adaptation for enhancing community resilience” organised by the International Centre for Climate Change and Development; hosted by the UNCDF Pavilion.

The COP28 was also the opportunity to follow up on our COP27 side event with Niger’s Agrarian Development Bank on their initiatives to promote rural insurance schemes.

The COP28 Innovation Zone

Last but not least, this year’s Innovation Zone welcomed a wealth of initiatives on innovation, sustainable finance, hydrogen, and agriculture. This proved to be a valuable opportunity to sharpen each others’ minds on upcoming trends.