The third week of 2023 saw the world gather once again for the World Economic Forum in Davos. From January 16th to 20th, political, economic, and civil society leaders from around the globe met in the Swiss Alps to discuss the economic future of our world.

This year’s focus on “Cooperation in a fragmented world” proved a theme of particular interest for The Bridge Tank to exchange views with participants from all over the world on the state of international cooperation, particularly with regard to South-South and South-North cooperation.

The Bridge Tank was in Davos during annual meeting of the WEF, represented by its chairman Joel Ruet and board members Judit Arenas, from Mexico, Raphael Schoentgen, from Belgium, and Pranjal Sharma, from India.

This active presence on the ground saw our board members discuss the place of the Global South in the digital revolution, explore new financial mechanisms of South-North cooperation, organise events on global public goods, and provide an overview of the diverse ambitions and paths of major emerging markets.

The digital revolution and the Global South

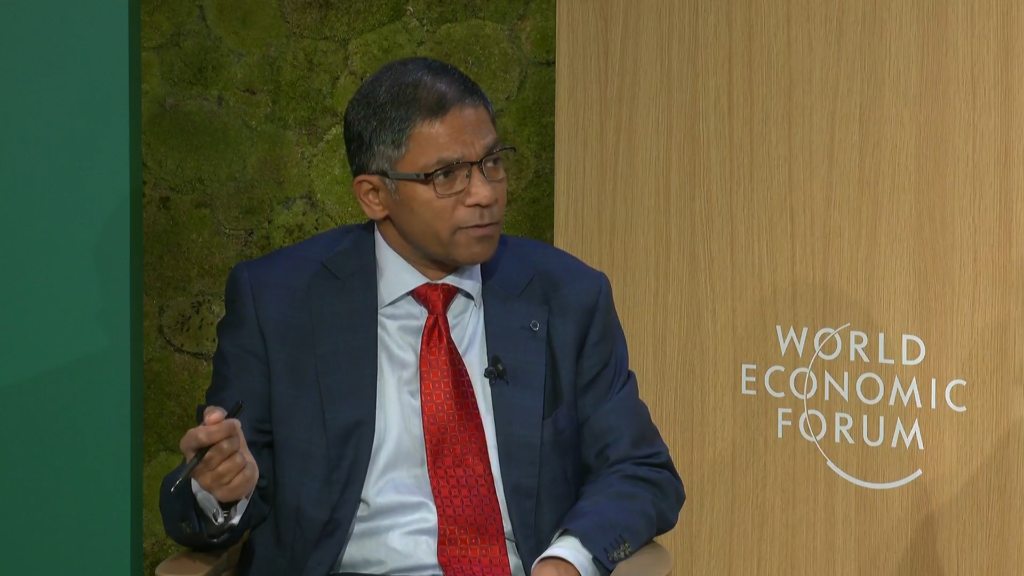

A regulard speaker at the WEF, our board member Pranjal Sharma highlighted the role of the Global South, acting as a structuring force to shape the future. Pranjal Sharma particularly pointed to India’s role in strengthening digital economies in the Global South and the country’s efforts in bringing the digital revolution to new communities and new languages.

Building on this question of digital revolution, Mr Sharma convened a WEF panel discussion on “Tackling Harm in the Digital Era,” in which he addressed user safety in online environments and how to build safer digital spaces.

The high-level panel gathered the European Commission’s Vice-President for Values and Transparency, the UK’s Office of Communications Chief Executive, and the Deputy Prime Minister of Belgium to discuss regulatory frameworks and technological innovations to tackle harmful content, violence, and abuse online.

The discussion highlighted the challenges facing lawmakers, as Mr Sharma asked them how to manage digital harm at scale and how to ensure protection for communities not only in developed countries but also in emerging economies, as billions of people and new communities are coming online.

A

Blue Finance: International rivers as a vector of South-North cooperation

The WEF also allowed discussing new forms of South-North cooperation. One such innovative mechanism on the blue finance front was discussed during an exclusive event on “Innovative Impact Investing through Blue Peace Bond,” organised by the United Nations Capital Development Fund (UNCDF) and the Swiss Agency for Development and Cooperation (SDC) at the House of Switzerland.

The event, which Joel Ruet and Raphael Schoentgen attended, presented the Blue Peace Financing Program and the creation of the Blue Peace Bonds, which aim to facilitate access to capital for river basin organisations and similar local and regional entities working toward multi-stakeholder transboundary cooperation around water. This innovative tool to finance infrastructure and social development hopes to work as a peace dividend, by making water an entry point for peace and cooperation.

As pointed out by the interventions of Mr Ruet and Mr Schoentgen, this South-North cooperation must not only involve the Global North’s financial institutions but needs to incorporate the Global South financial institutions and financial services providers to serve as an opportunity for the Global South to develop and leverage its own financial ecosystem.

This session and the financial tool built on cooperation around water it presented came as a welcome contribution to The Bridge Tank’s research for new tools to mobilise within an expanded practice of hydro-diplomacy, just a few weeks after the launch of the World Water for Peace Conference.

The Bridge Tank’s Innovation Lunch 2023: Strengthening biosecurity cooperation

Concluding the week on the theme of cooperation, Joel Ruet and Judit Arenas joined forces on the last day of the forum to co-organise a luncheon discussion on Davos’ Promenade on the issue of biosecurity and bioterrorism. The event was the result of a partnership between The Bridge Tank, APCO Worldwide, and the American biotechnology company Illumina.

The session moderated by Joel Ruet and John Defterios, former CNN economic analyst and anchor, and senior advisor, APCO Worldwide, highlighted the fragility of national and international biosecurity frameworks and the lack of necessary biosecurity infrastructure, and called for greater public-private cooperation on this matter.

The select group of participants consisted of around 25 renowned biosecurity and cybersecurity specialists, high-level academics, and C-suite executives, like John Frank, Chief Public Affairs Officer, Illumina, Richard Hatchett, CEO, Coalition for Epidemic Preparedness Innovations (CEPI), or Frank-Jürgen Richter, Chairman, Horasis.

Focus on the pavilions and thematic sessions in Davos

The vibrant activity of the different national and corporate pavilions made for vivid discussions and for events on themes of interest for The Bridge Tank, i.e. emerging economies, sustainable development, and structuring energy transitions.

The India Lounge was an important meeting point at this year’s WEF. Joel Ruet attended a panel discussion on India’s environmental, social, and governance (ESG) investments and a business-government debriefing on the world’s – and particularly the US’ – readiness to reengage with China. One of the conclusions stressed that whether investments will remain in China or be relocated is something India will have to follow closely.

This presence at the India Lounge was also an opportunity to meet with Samir Saran, President of the T20 Secretariat, and discuss The Bridge Tank’s involvement in the T20 during India’s 2023 G20 presidency. With themes of cooperation and inclusive growth at the heart of India’s presidency, The Bridge Tank will provide an active contribution to the T20 on themes of blue and green finance and bridging the gap between the African continent and the G20.

Indonesia: Setting the course for a net zero future

Indonesia, which only recently handed over the presidency of the G20 to India, proved to be very active in Davos as well.

The Indonesian pavilion thus hosted a session on “Indonesia Net Zero Pathway: Opportunity & Challenges,” on January 17th.

A presentation by Muhammad Yusrizki, Chair of KADIN Net Zero Hub, Indonesia Chamber of Commerce, introduced some of the objectives and challenges ahead for Indonesia’s green transition, including how to finance the energy transition and de-risk investments in renewable sources in Indonesia but also the need for policies and institutional frameworks to accelerate the country’s journey to net zero.

Mr Yusrizki particularly stressed the need to protect and regenerate mangroves, as these have huge potential for carbon storage in a country home to more than 20% of the world’s mangrove areas.

Indonesia’s Coordinating Minister for Maritime and Investment Affairs, Luhut Binsar Pandjaitan, introduced Indonesia’s pathway and sectoral priorities to achieve net zero by 2060. Such a pathway would be based on industrialisation and economic development, Mr Pandjaitan said, as he reminded attendees that Indonesia’s per capita CO2 emissions were lower than the global average.

Indonesia’s green economy will be built on five pillars:

- a decarbonized power sector – helped by the Just Energy Transition Partnership (JETP), which hopes for renewable energy to comprise 34 percent of Indonesia’s power generation by 2030;

- low-carbon transportation – through the development of electric vehicles;

- alternative fuels, e.g. biofuel;

- green industries, e.g. by developing an EV battery supply chain;

- carbon sinks – involving carbon capture and carbon offset market.

Indonesia hopes to make transportation an important pillar of this green economy. As the ASEAN’s largest automotive market, Indonesia represents 30% of the ASEAN 4-wheeler market and 50% of its 2-wheeler market. While the country still relies on imports, Indonesia hopes to become a production hub in the region, particularly for EVs, for which Indonesia is working to develop its own value chain.

Indonesia also aims to become a global leader in climate mitigation and in the carbon offset market. Replanting mangroves and restoring degraded ecosystems and lands are expected to be some of the key action areas, as panellists noted.

Africa House : Discussing AfCFTA & unlocking the continent’s future potential

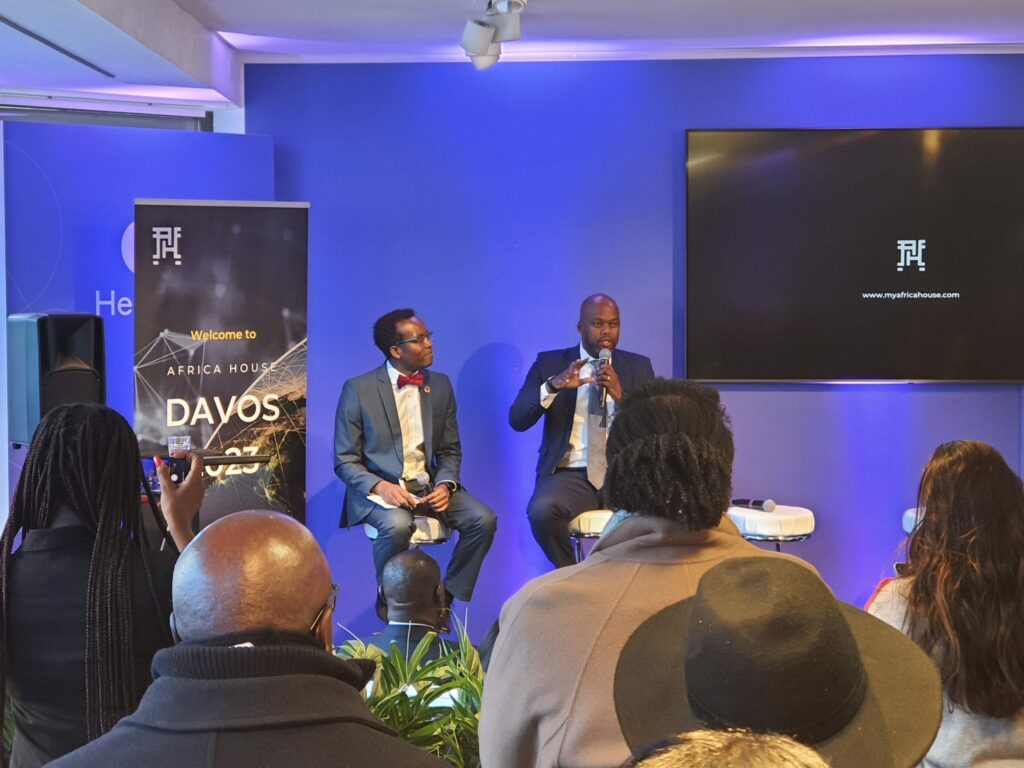

The African continent provided its own contribution to this year’s WEF’s pursuit of cooperation in a fragmented world. Davos’ Africa House hosted a trade panel, titled “Deep-dive into the AfCFTA, exploring how far it has come and unlocking the continent’s future potential,” on January 18th.

Participants to the panel included:

- Wamkele Mene, Secretary-General, AfCFTA Secretariat

- Samaila Zubairu, President & CEO, Africa Finance Corporation

- H.E. Princess Alanoud Bint Hamad Al Thani, Chief Business Officer, Qatar Financial Centre

The African Continental Free Trade Area (AfCFTA) encompasses 54 countries across the continent, with 44 state parties having already ratified the agreement. This free trade area however constitutes only 2.1% of global trade and 3% of the world’s GDP.

In his opening address to the panel, Wamkele Mene therefore noted that individual African countries will not be globally competitive on their own. Mr Mene went on to stress the African continent’s need for greater integration in order to develop economies of scale and overcome its reliance on the export of commodities of primary necessity.

The panel encouraged an accelerated implementation of the AfCFTA, as it provides a blueprint for Africa’s collective development and industrialisation. The COVID-pandemic played an important role in revealing Africa’s need to establish alternative supply chains. With Africa at the back of the queue for masks and vaccines, the need for the continent to become self-sufficient has arguably become more pressing.

Samaila Zubairu, President & CEO, Africa Finance Corporation, highlighted the fact that the value chains of products like cocoa, cashew nuts, and cotton are not in Africa; the processing of this production is carried out abroad before being re-imported. The same applies to EV vehicles, despite Africa being an important source of strategic materials with huge solar energy potential, Mr. Zubairu noted, before concluding that Africa suffered from a 100 billion infrastructure deficit, weakening its ability to grow.

While panelists commended AfCFTA’s efforts in interconnecting supply chains and regulations and appeared optimistic about the agreement’s success – finding inspiration in the process of European integration started at the end of WW2 which resulted in today’s European Union – considerable challenges remain to reach such a level of integration. A notable limitation is the absence of a protocol on freedom of movement between parties, as pointed out by a question from the attendance.

The Future of Supply Chains and Investments in Emerging Markets

A session organised at the DP World pavilion on “Unlocking Investments in Emerging Economies” addressed the significance of supply chains in today’s world, particularly in the aftermath of the COVID-19 pandemic. Panellists noted that the lack of investments in the less developed parts of the world created disruptions in supply chains. A greater integration of supply chains and investments in infrastructure would however allow the transmission of benefits to emerging countries.

The diversification of supply chains post-COVID, therefore, has the potential of benefiting countries like the Philippines or India, panellists noted, as they could take over parts of China’s role in supply chains. These changing dynamics have begun redistributing roles in international supply chains. The wish of countries like the US and Canada to bring supply chains nearer to home would for example benefit a country like Mexico.

The session’s moderator Frederic Sicre, Managing Partner, Tardis Advisors, therefore shed light on this evolving understanding of emerging markets, mentioning the acronym BIMCHIP (i.e. Brazil, India, Mexico, Chile, Indonesia and Peru) as a possible replacement for the BRICS label.

Participants however also pointed to the challenges resulting from current financial uncertainty, which has made access to capital more difficult. This financial uncertainty will dampen the investment potential in emerging markets, as investors will prioritize less risky investments in developed markets, panellists noted.