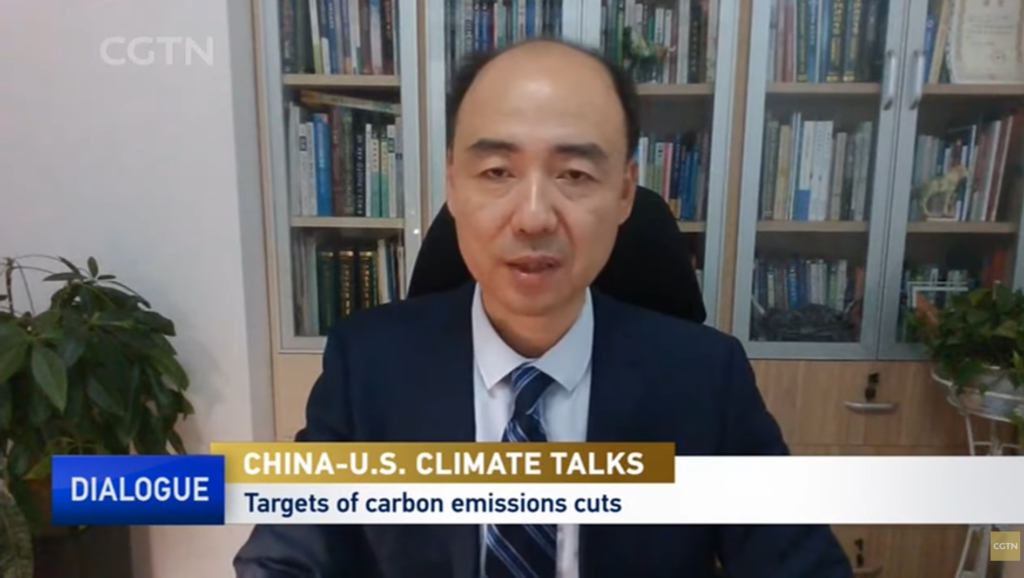

The Bridge Tank: US-China climate talks should not forget the Global South – CGTN Dialogue

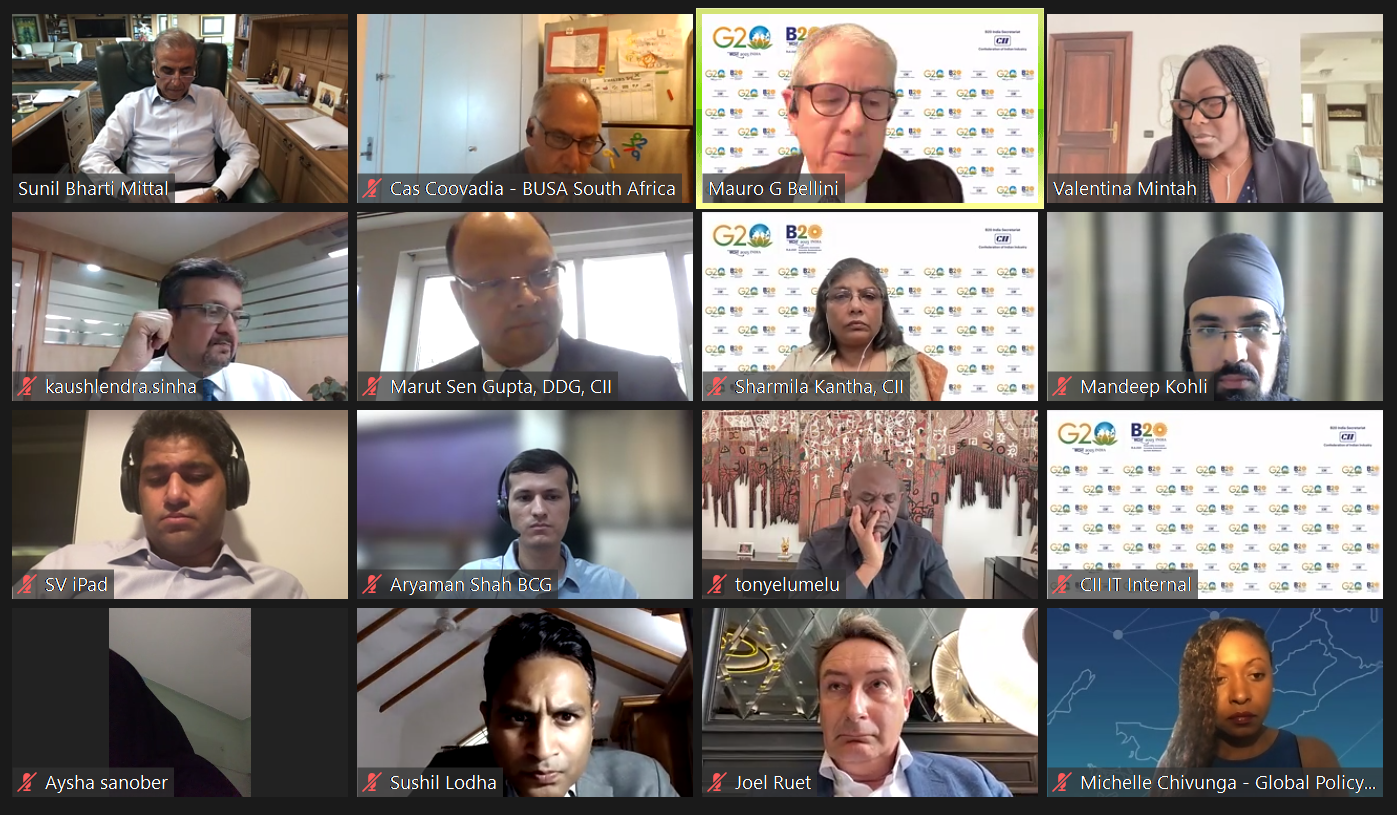

Following the restart of China-U.S. climate talks and the three-day visit of U.S. Climate Envoy John Kerry to Beijing mid-July, Joel Ruet joined CGTN’s Xu Qinduo on “Dialogue” to discuss the importance of these talks between the two largest economies & greenhouse gas emitters on the planet and address some of its priority topics. From carbon emissions reduction to the acceleration of climate finance, the Global South must imperatively be involved in global climate action, Joel Ruet stressed. An important discussion to rewatch here.

The discussion was also joined by Chinese environmentalist Ma Jun, Director of the Institute of Public & Environmental Affairs and U.S entrepreneur Brandon Andrews, former Hill staffer.

Stressing the importance of these talks, Ma Jun highlighted the impact of both China and the U.S. in global GHG emissions, which “put together […] is nearly half of the global total.” Echoing this idea, Joel Ruet noted that there were two stringent issues which the two countries needed to address, “the first one is the emissions […], the second one is climate finance, which has to be accelerated,” notably towards the Global South.

1. Cutting emissions

As U.S. Climate Envoy John Kerry stressed the need for China to decarbonize the power sector, cut methane emissions, and reduce deforestation, Ma Jun put China’s evolution and its goals for emissions to peak before 2030 and for carbon neutrality before 2060 into perspective.

“China is going through a massive industrialisation and urbanisation. Unlike Western countries which have naturally peaked their emissions and try to bend the emission reduction curve faster, China has not completed its industrialisation and urbanisation.”

Ma Jun, Director of the Institute of Public & Environmental Affairs

Still, China’s coal consumption has remained relatively stable since 2013, after having nearly tripled between 2000 to 2011. “China’s renewable energy target set for 2030 will be achieved by 2025” and its “EV targets for 2025 have been surpassed last year,” Ma Jun added.

Reacting to this assessment, Joel Ruet pointed out a twofold challenge, i.e. “scaling up those renewable energies that work and […] preparing the energies of the future like green hydrogen, for which we need research and an industry.”

Through the example of hydrogen, Mr Ruet reminded the audience that renewable energies produce electricity, which is only one form of energy, the others being solid (e.g. coal), liquid and gas. According to Joel Ruet “China will be able to gradually exit from coal only if it mobilizes the other sources of energy,” i.e. liquid and gas. On gas, the world therefore needs “a global alliance between China, the US and Europe to develop and invest in those technologies which are not yet mature for the market, mainly on green hydrogen.”

2. Climate finance

While traditional finance very much relies on assets which are either in the country of origin or in the global economy, connected to trade, Mr Ruet stressed that developing green finance will be achieved through “land restoration and carbon sinks through forests in Africa, Borneo Forest, Asia, Latin America and all around the world. The underlying factors of those assets are widespread, making it much more an issue of political economy and of involving the Global South in building this finance. Green finance will have to be much more collaborative than previous financial models.”

“Both China and the US have an edge in climate finance. It will be very important for these two poles of climate finance in the world to cooperate rather than compete.”

Joel Ruet, Chairman, The Bridge Tank

According to Ma Jun, China has indeed a lot to offer in terms of innovative financial models to face climate change.

China’s experience with solar power has seen the country develop “micro financing arrangements which allow rural households to take advantage of their rooftop to get clean energy and make money out of it.”

Combining “poverty relief and rejuvenation the countryside,” this model of micro-financing and rooftop solar panels “could be applied to other parts of the world and synergized to achieve the SDGs,” Ma Jun concluded.

From the curbing carbon emissions to bolstering climate finance, China-US climate talks must involve and support the Global South for international climate action to be both effective and inclusive.