The Bridge Tank’s presence in Davos, Switzerland during the World Economic Forum 2023 and its participation to the UN 2023 Water Conference in New York set two new milestones in The Bridge Tank’s research on innovative financial tools in support of hydro-diplomacy, in the weeks following the launch of the World Water for Peace Conference.

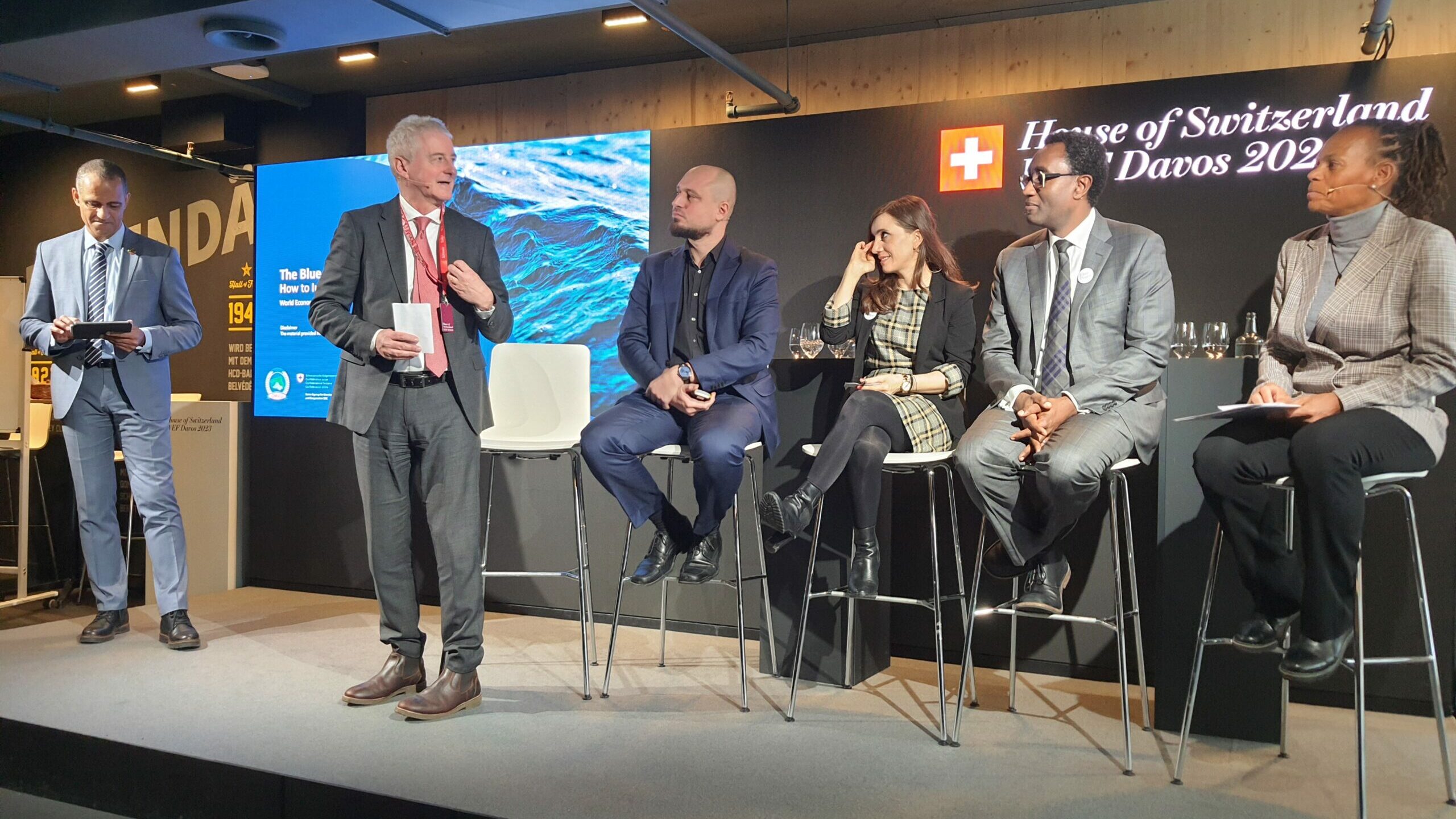

On Thursday, January 19th, 2023, the promotion of transboundary water cooperation found a home at the House of Switzerland in Davos. Represented by its chairman, Joel Ruet, and board member Raphael Schoentgen, The Bridge Tank attended an event on “Innovative Impact Investing through Blue Peace Bond” co-organised by the United Nations Capital Development Fund (UNCDF) and the Swiss Agency for Development and Cooperation (SDC). Two months later, on March 23rd, during the UN 2023 Water Conference, The Bridge Tank took part in a second session on this very topic at the UN Headquarters in New York, through the presence of Joel Ruet and Cédric Terrasson, Editor & Junior Analyst.

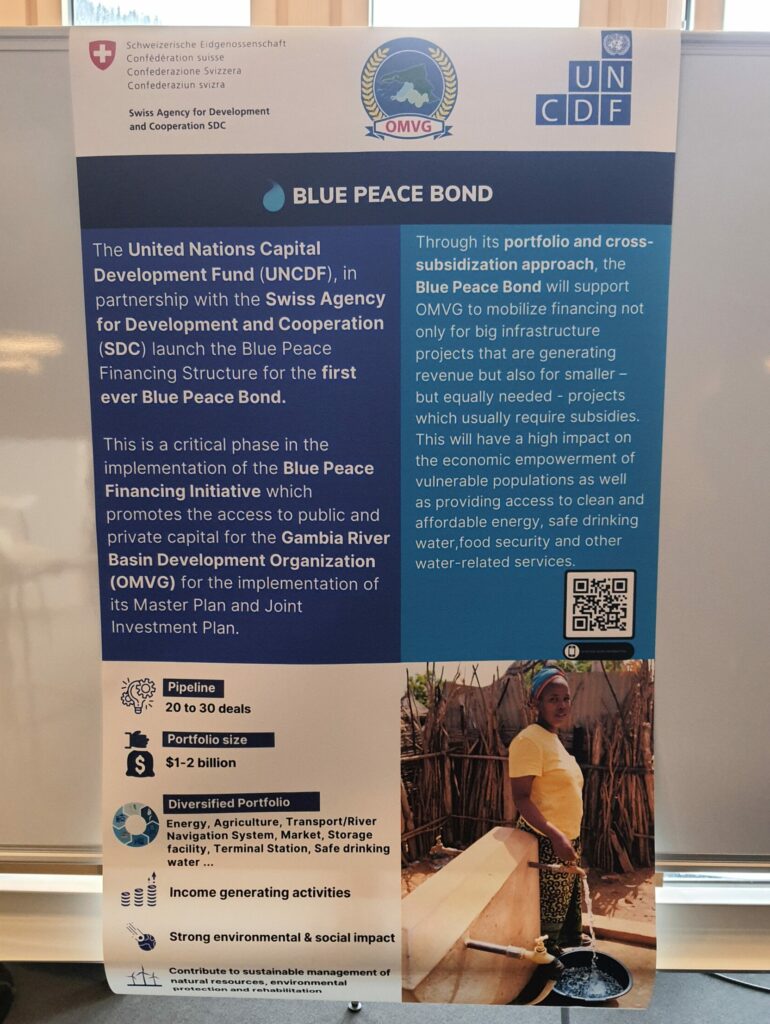

These two sessions presented the vision and the potential of the Blue Peace Financing Initiative, a promising new blue finance programme which aims to use water and transboundary rivers as an entry point for peace-building and socio-economic development. The programme will help develop and provide financial support to multi-sectoral cooperation frameworks pursuing sustainable and integrated co-management of transboundary rivers and water resources. Blue Peace will help scale up those frameworks and their associated investment plans by issuing Blue Peace Bonds, which will facilitate access to public and private capital.

This is of particular interest for River Basin Organisations (RBOs) all around the world, as the pilot projet for which the first Blue Peace Bond will be issued in 2023 has been developed in support of a West-African RBO, i.e. the Gambia River Basin Development Organization (Organisation pour la mise en valeur du fleuve Gambie, OMVG).

Investing in Water for Peace and Development

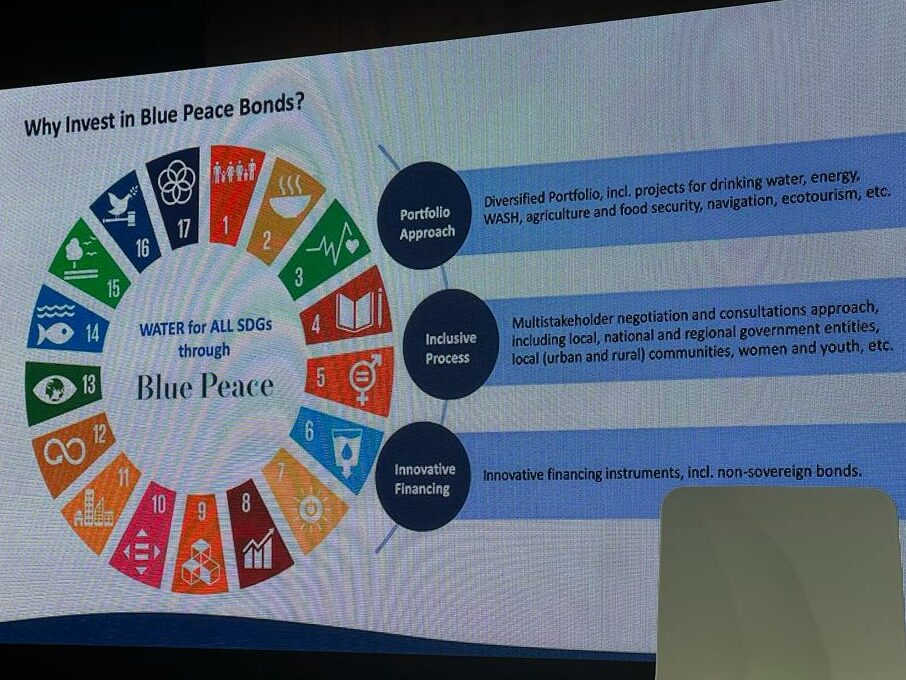

In keeping with the UN Sustainable Development Goals, the Blue Peace Financing Initiative aims to provide affordable, inclusive, and safe access to water-related services in order to ensure food security, access to clean drinkable water, and affordable green energy.

The programme approaches water as a vector for peace, cooperation, and socio-economic development by fostering a more equitable, sustainable, and peaceful integrated management of transboundary water resources.

The Davos session was opened by Patricia Danzi, Ambassador, Director General, SDC, and moderated by Christian Frutiger, Ambassador, Assistant Director General, SDC, who gave the floor to the following panellists to discuss the vision and structure of Blue Peace:

- Jaffer Machano, Global Program Manager, UNCDF

- Rukan Manaz, Program Specialist, Blue Peace Financing, UNCDF

- Hans-Ruedi Mosberger, Head of Asset Management and Sustainability, Swiss Bankers Association SBA

- Matus Samel, Research Manager, Economist Impact

At the UN 2023 Water Conference, the session was opened by Mourad Wahba, Officer in Charge, United Nations Capital Development Fund (UNCDF) and saw contributions from:

- Daouda Samba Sow, Secretary General, OMVG

- Rohey John Manjang, Minister of Environment, Climate Change and Natural Resources, The Gambia

- Usha Rao-Monari, Under-Secretary-General and Associate Administrator of UNDP

- Benjamin Powell, Head of Sustainable Debt Capital Market, Skandinaviska Enskilda Banken (SEB),

- Tania Rödiger-Vorwerk, Deputy Director General, Federal Ministry for Economic Cooperation and Development (BMZ), Germany

- Marjeta Jager, Deputy Director General, DG INTPA, European Commission

- Douglas R. Eger, Chairman & CEO, Intrinsic Exchange Group

Supporting RBOs to foster change

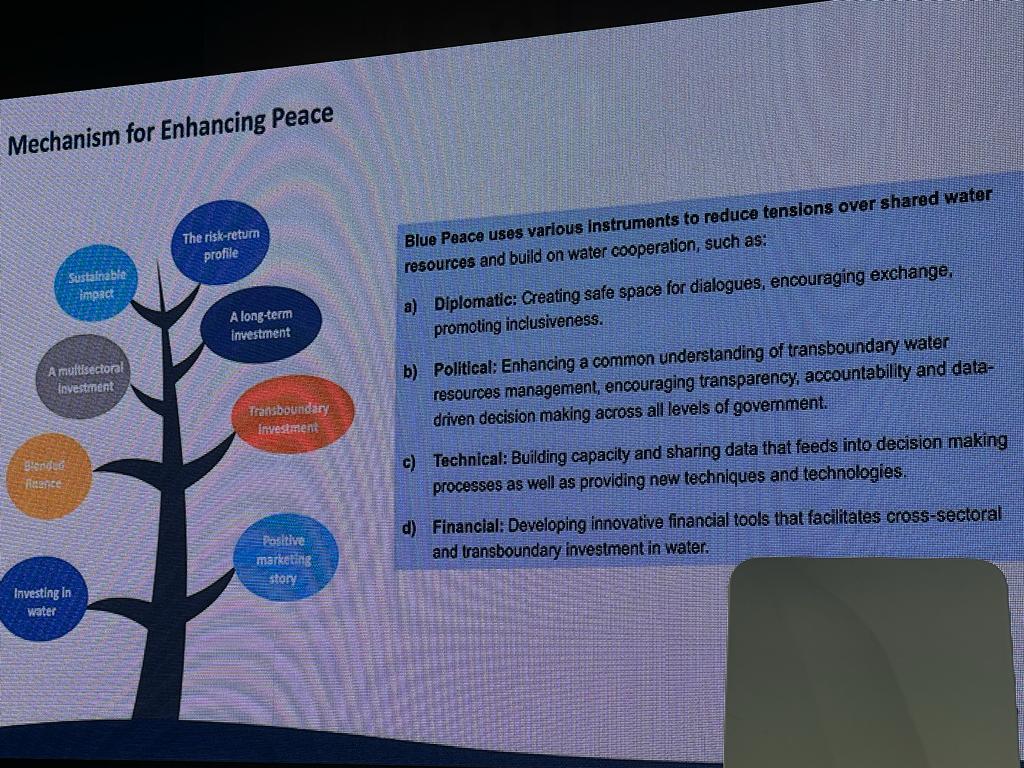

Representing the UNCDF, Jaffer Machano and Rukan Manaz introduced the approach and structure of the Blue Peace Financing Initiative to the Davos audience. With pressure on water resources having become one of the great challenges of our times, water has become a source of tension and conflict in many regions around the world. Trying to break this downward spiral, the ambition of Blue Peace is to turn this contentious issue into an entry point for cooperation and sustainable development.

Blue Peace’s goal and overall mission is to generate and support water cooperation initiatives and develop a common understanding of transboundary water resources management by encouraging data-driven decision making. To reach this objective, Blue Peace comes in support of local & regional non-sovereign entities in charge of water management, e.g. River Basin Organisations.

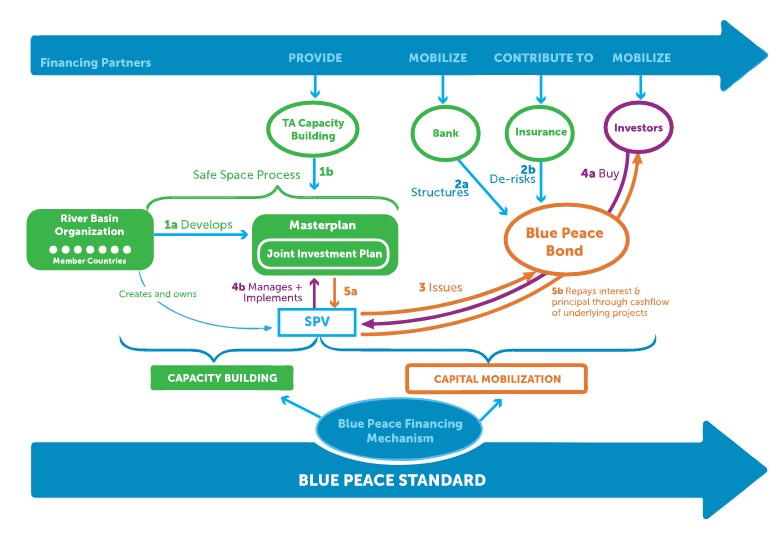

Blue Peace’s support is structured around two essential activities:

- Capacity building and technical development;

- Facilitating access to public and private capital through an innovative financial tool, i.e. Blue Peace Bonds.

This is best exemplified through the Blue Peace Financing Initiative’s pilot project.

A Pilot Case in West Africa: the Gambia River Basin Development Organization

1. Capacity building and technical assistance

The Gambia River Basin Development Organization (OMVG) is an RBO which handles the co-management and development of the Gambia River Basin. It comprises four member states, from the springheads to the delta of the Gambia River: Guinea, Guinea-Bissau, Senegal, and Gambia.

In December 2019, the OMVG and the UNCDF signed a Collaborative Partnership into existence between the two organisations. The OMVG Council of Ministers subsequently issued a resolution (Nr.13/CM/45/B/G) green-lighting the development of the “OMVG Masterplan for the Integrated Development of its river basins, which will serve as the basis for the OMVG joint investment plan.” Such a Masterplan covers projects as diverse as the development of hydro-power, access to drinking water, natural parks, irrigation of farmlands, or transport and navigation systems.

This encapsulates the first stage of Blue Peace. The technical assistance and institutional capacity building supports the development of this multisectoral masterplan, offering a long term development perspective carried out by the joint investment plan.

2. Facilitating access to capital

In the second stage of the Blue Peace Financing Initiative, the partnership between the OMVG and UNCDF helps equip “the OMVG with the adequate tools to develop innovative financing mechanisms that will enable it to directly access the financial markets through the issuance of bonds.”

In order to scale up and meet the objectives of the masterplan and joint investment programme, the regional sub-sovereign entity (in this case the OMVG, a multi state organisation) will issue a Blue Peace Bond in order to mobilise capital. This is done through a Special-purpose entity (SPV) created and owned by the River Basin Organisation, which is in charge of managing and implementing the Investment Plan.

Building on the Masterplan for integrated development, the portfolio approach of the Blue Peace Bonds allows to combine large infrastructure projects that are generating revenue with smaller but equally important projects which have a higher dependence on subsidies. This diversification and cross-subsidization offered by Blue Peace Bonds helps derisk investments while also funneling funds to smaller projects.

Blue Peace Financing Partners support the Blue Peace Bond by mobilizing banks and investors, while also contributing to the de-risking of the Bond. The SPV is in charge of repaying interest and principal through the cashflow of underlying projects. In 2023, the first phase of capital mobilization will cover between 500 and 750 million USD, with 2 billion USD in perspective over the coming years.

Facilitating future Blue Peace projects

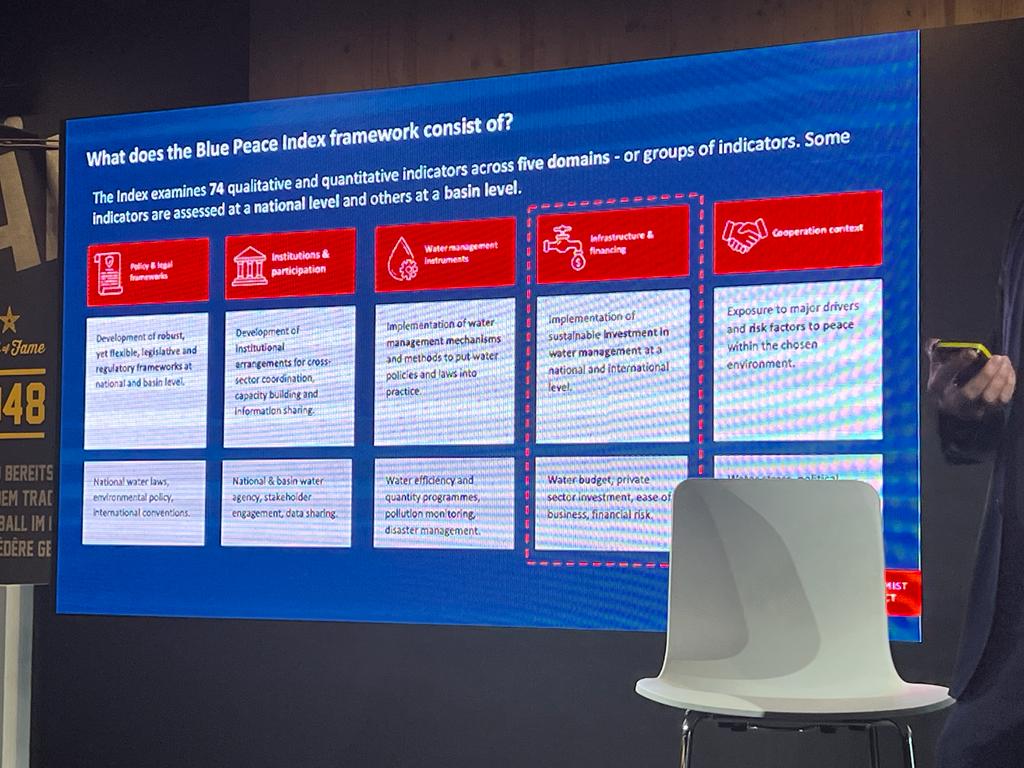

A tool which will play an important role in supporting the Blue Peace Financing Initiative is the Blue Peace Index. Matus Samel, Research Manager, Economist Impact, introduced the index to the participants as a tool measuring the extent to which countries and basins manage their shared water resources in a sustainable, equitable and collaborative way.

The index analyses 74 qualitative and quantitative indicators across five domains:

- Policy & legal frameworks – development of legislative and regulatory frameworks at national and basin level

- Institutions & participation – institutional arrangements for cross-sectoral coordination, capacity building and information sharing

- Water management instruments – implementation of water management mechanisms

- Infrastructure & financing – implementation of sustainable investment in water management

- Cooperation context – exposure to major drivers and risk factors to peace

The Index provides an overview of the enabling environment for financing and investment in transboundary water management. The Blue Peace Financing Initiative Readiness Assessment will promote suitable investments by helping identify appropriate actors to support.

Attracting Investors for Blue Peace

As noted by Hans-Ruedi Mosberger, Head of Asset Management and Sustainability, Swiss Bankers Association, the Blue Peace Bond has the benefit of having been designed with the investor’s perspective in mind.

Mr Mosberger stated that investors do not like one-off investments; they favour scalable and replicable projects, which create a track-record reducing the risk of the investment. The diversification offered by the portfolio and cross-subsidization approach of Blue Peace, building on the Masterplan for integrated development, contributes to this improved risk-return.

The Blue Peace Financing Structure is a promising mechanism involving blended finance, i.e. using public funds to generate momentum and subsequently raise private capital, and non-sovereign bonds to create impact through water and transboundary rivers.

As however pointed out by the interventions of Mr Ruet and Mr Schoentgen during the Q&A session in Davos, this South-North cooperation must not only involve the Global North’s financial institutions but needs to incorporate the Global South’s financial institutions and service providers to serve as an opportunity for the Global South to develop and leverage its own financial ecosystem.